PUBG Mobile 4.2 "Primewood Genesis": A Data-Driven Analysis of the Jan 7 Update

On January 7, 2026, PUBG Mobile officially launched its massive 4.2 update. If you’ve been tracking the game via Appark, you noticed an immediate shift in its store presence.

The 4.1 "Frosty Funland" is gone. Welcome to "Primewood Genesis."

But for industry analysts, the story isn't just about a new map. It's about a complex global publishing strategy involving Tencent, Krafton, VNG, and segmented markets. Let’s analyze the data.

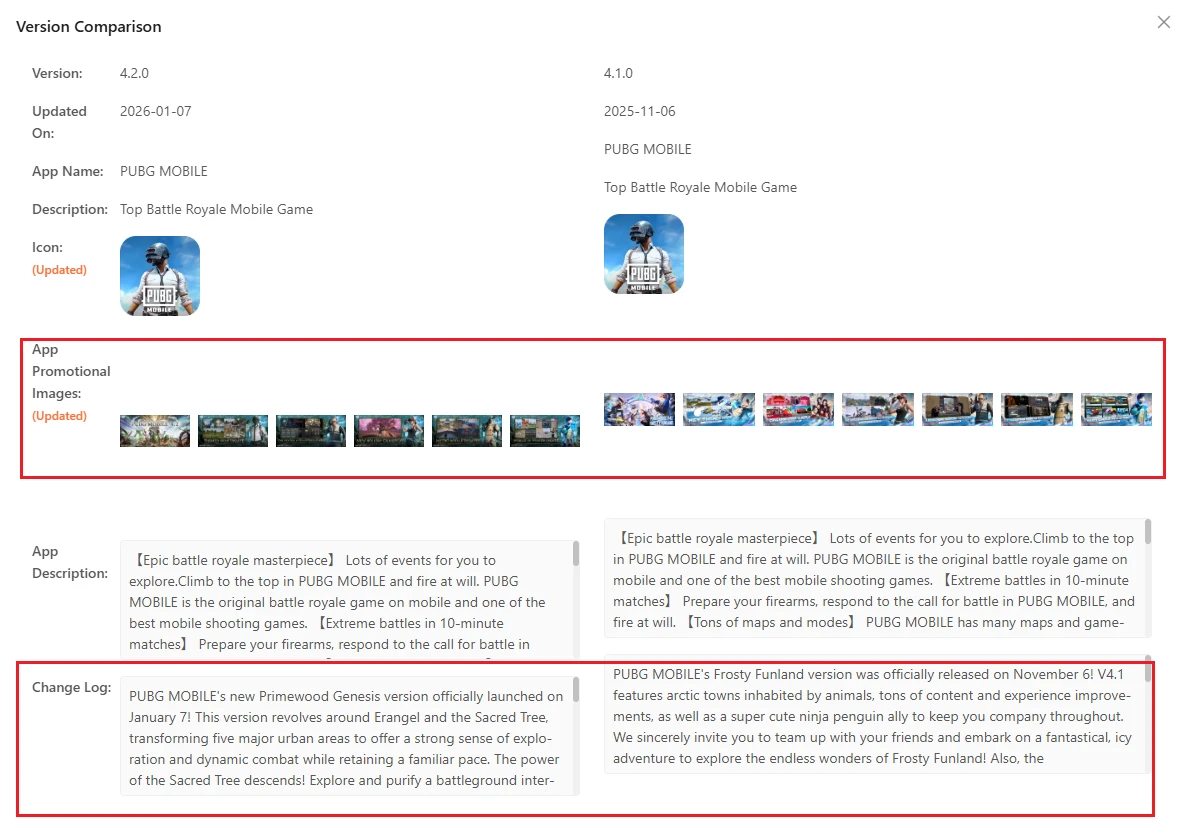

1. Visual ASO Pivot: Strategic Continuity vs. Content Shock

The most interesting insight from Appark’s Version Comparison tool is how PUBG Mobile balances brand consistency with seasonal hype.

While the App Icon remained unchanged to maintain brand recognition, the Hero Promotional Image (the first screenshot users see) underwent a violent palette swap.

- V4.1 : Dominated by "Frosty Funland" blues and winter elements.

- V4.2 : Shifted to "Primewood Genesis" greens, featuring the World Tree.

Key Observations:

- Visual Contrast: This "Green vs. Blue" contrast serves as a visual trigger for lapsed players, instantly signaling that the winter season is over and new content is live.

- Changelog Keywords: The log explicitly introduces "Barkle" (the new Treant ally) and the "Peaky Blinders" collaboration (Jan 9), front-loading these terms for search visibility.

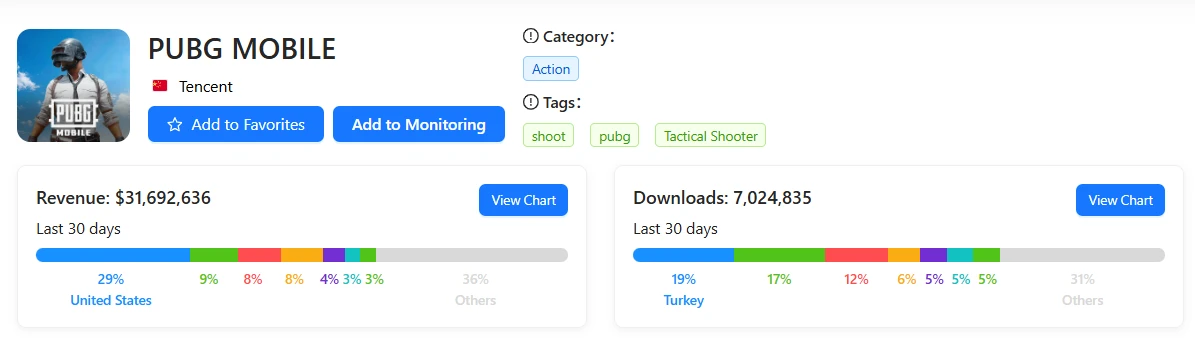

2. Global Reaction: Turkey Drives Volume, US Drives Value

Using Appark's Overview Header for the Global version (Published by Level Infinite), we can see exactly where the 4.2 update is making an impact.

The "Volume vs. Value" Split:

- Downloads (Turkey Leads): While the US market is often the focus, Appark data reveals that Turkey is currently the #1 driver of new installs, accounting for 19% of the 7M downloads in the last 30 days.

- Revenue (US Leads): Despite lower download numbers, the United States contributes 29% of the $31.1M monthly revenue.

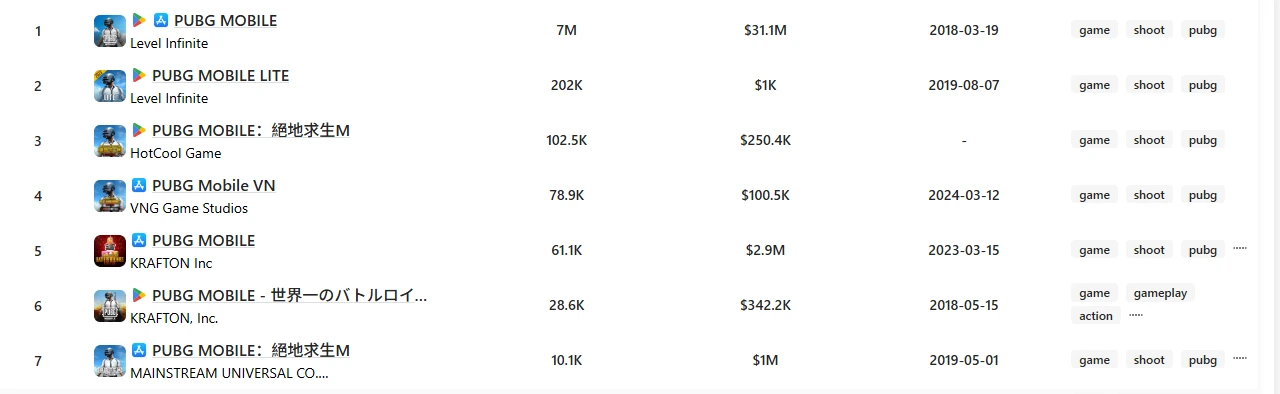

3. The "Hidden" Galaxy: Mapping Regional Fragmentation

Here is where amateur analysis fails. Many tools lump "PUBG" into one single entry, causing inaccurate market sizing.

Appark's search engine reveals the truth: PUBG Mobile is not one app; it is a galaxy of regional variants.

Deciphering the Ecosystem (Data from Jan 2026):

- The Global Giant: Row 1 shows the Level Infinite version dominating with $31.1M in revenue.

- The Korean Heavyweight: Row 5 shows the KRAFTON Inc version. While it has fewer downloads, it quietly generates an additional $2.9M monthly revenue primarily from Korea and Japan.

- The Specialized Outposts: Appark also detects the Vietnam version (published by VNG, Row 4) and the Taiwan version (published by HotCool, Row 3).

Why This Matters: If you only track the "Global" App ID, you are underestimating the IP's total monthly revenue by over 10% (approx $3M+). Appark allows you to monitor all these variants individually to get the complete picture.

4. Competitive Landscape: The Battle for #1

Finally, we used the Competitors module to contextualize PUBG's position against rivals like Free Fire MAX.

Appark Comparative Analysis:

The Revenue Gap: Free Fire MAX ($35.5M) and Call of Duty: Mobile ($34.5M) have slightly outperformed PUBG Mobile Global ($31.1M) in revenue over the last 30 days.

The Quality Advantage (RpD): However, PUBG Mobile holds a secret weapon—User Quality.

- PUBG Mobile (Global) RpD: ~$4.51

- Free Fire MAX RpD: ~$2.64

Even though Free Fire has nearly double the downloads (13.5M vs 7M), PUBG Mobile extracts significantly more value per user. The 4.2 "Primewood Genesis" update is strategically designed to close the download gap while maintaining that superior monetization efficiency.

Conclusion

The transition to 4.2 is a masterclass in global segmentation.

- Visual Strategy: Updating screenshots to signal "Newness" while keeping the Icon stable for brand safety.

- Fragmented Publishing: Using Level Infinite for Global, Krafton for KR/JP, and VNG for Vietnam—all tracked seamlessly on Appark.

- High RpD: Prioritizing high-value users over raw download volume.

Do you know if your competitors have hidden regional apps draining your market share? Sign up for Appark and search your category today.

Frequently Asked Questions

Q: Why are there multiple versions of PUBG Mobile on Appark? A: PUBG Mobile uses a regional publishing strategy. Different companies publish the game in different regions (e.g., VNG for Vietnam, Krafton for Korea) to comply with local laws and optimize live ops. Appark tracks each independently.

Q: Which PUBG version makes the most money? A: The "Global" version published by Level Infinite is the largest, earning ~$31.1M in the last 30 days. However, the Krafton version adds a significant ~$2.9M to the total.

Q: What is the main theme of PUBG Mobile 4.2? A: The theme is "Primewood Genesis", focusing on the Sacred Tree, infected plants, and new forest-themed vehicles.

Q: Is PUBG Mobile earning more than Free Fire? A: Globally, Free Fire MAX is slightly ahead in total raw revenue, but PUBG Mobile demonstrates a significantly higher Revenue per Download (RpD).