Mobile App Competitor Analysis Made Easy: Turn Data into Market Insights with Appark

Introduction — Why Competitor Analysis Matters More Than Ever

If your app isn’t getting installs while competitors climb the charts, you’re not alone.

Many teams check downloads or rankings occasionally — and then wonder why growth stalls. That’s not analysis. That’s casual observation.

True mobile app competitor analysis turns scattered signals into a clear roadmap: which features to build, where to spend ad dollars, which markets to push into, and when to pivot.

This guide gives you a practical, repeatable approach — grounded in real metrics and action — so you can turn competitor data into product decisions. It’s organized around:

- The 4 factors that matter most.

- An 8-step process you can execute today.

- Worksheets and examples you can copy.

- A short list of the best tools (including Appark).

By the end you’ll be able to run meaningful competitor analysis, produce a one-page plan, and start monitoring the right signals automatically.

What Is Mobile App Competitor Analysis?

Mobile app competitor analysis is the process of tracking and comparing apps that compete for the same users, attention, and revenue. It’s more than just “who’s #1”: it’s about understanding why apps win.

A proper analysis includes:

- Download & revenue trends (who’s growing, where).

- Ranking & category shifts (where apps rise or fall).

- ASO & creatives (what messaging works).

- Feature and UX differences (what retains users).

- Monetization models (ads, subscriptions, IAPs).

- User feedback and reviews (qualitative signals).

- Paid UA activity (ads and promotional bursts).

Why Competitor Analysis Is Hard (and Why Most Teams Get It Wrong)

Most teams fail at competitor analysis for five reasons:

- Data is fragmented. Ranking, keyword, revenue and ad data live in different places.

- Manual tracking is time-consuming. Apps change daily. Weekly spreadsheets fall behind.

- Wrong competitors. Category =/= competitor. The real rival is whichever app targets the same user need.

- They track vanity metrics. Top downloads look sexy — but downloads without retention mean nothing.

- No action plan. Insights don’t convert to experiments or roadmaps.

The fix: a repeatable process + unified metrics + automation. That’s the structure this guide provides.

4 Key Factors You Must Track in Mobile App Competitor Analysis

You can’t track everything. Focus on these four forces — they explain most competitive movement.

1. Market Environment

- Category growth or contraction.

- New entrants.

- Seasonal patterns.

2. User Behavior

- Who downloads and why.

- Which features drive retention.

- Where users churn.

3. App Store Rules & Algorithms

- Search ranking shifts.

- Featured placements and seasonal promos.

4. Ads & UA Landscape

- Which competitors are buying traffic?

- Ad creativity and frequency.

- Paid bursts that drive organic spikes.

Track these four forces consistently and your analysis will be strategic, not reactive.

8-Step Process to Run Mobile App Competitor Analysis Successfully

This is the core playbook. Follow these eight steps in order.

Step 1 — Get the Market Straight (Define Where You Play)

Before you analyze competitors, map the market.

- List top 3–5 tags where your app could belong.

- Check growth trends for each tag (monthly or quarterly).

- Identify reachable users: demographics, device types, regions.

- Note free vs paid mixes, and rate of new releases.

Quick output: a simple table with Category | Growth Trend | User Type | Competition Intensity. Why: Low competition + decent demand = hidden opportunity.

Step 2 — Build Your Competitor List (Don’t Pick by Feature Alone)

Gather candidates that truly compete for the same users.

Where to look:

- Top 100 apps in your shortlisted categories.

- “Competitor apps” sections in stores.

- Search results for your primary keywords.

- Social and referral mentions. Practical tip: keep direct, indirect and niche competitors in your spreadsheet.

Columns: App Name | Type | Rank | Downloads | Monetization | Notes.

Step 3 — Prioritize Key Competitors (You Can’t Track All)

Assign a focus score to each app: relevance × influence × growth, then prioritize.

- Market leaders (high influence).

- Direct rivals (feature overlap).

- Emerging threats (fast growth).

- Niche/backup (monitor casually).

Result: a short list of 5–10 “priority” competitors for deep tracking.

Step 4 — Analyze ASO & Ranking Signals (What Gets Them Seen)

Look at metadata and creatives:

- Titles, subtitles, descriptions — keyword use and updates.

- Icons, screenshots, preview videos — creatives and messaging.

- Localized pages — if regionally optimized.

- Ranking volatility — sudden jumps or drops.

Practical move: map 3 competitors’ ASO strategies in a table: Keyword Focus | Creative Style | Update Frequency | Notable tactics.

Step 5 — Identify Strengths, Weaknesses & Monetization Gaps

This is the competitive intelligence meat.

- Scrape top reviews: find repeated complaints or praise.

- Run the onboarding flows yourself: spot friction points.

- Compare monetization: subscription tiers, IAP prices, ad formats.

- Check localization and geo strategies.

Action: For each competitor, fill: Strengths | Weaknesses | Monetization | Immediate Opportunities.

Step 6 — Monitor Downloads, Revenue & Growth Trends

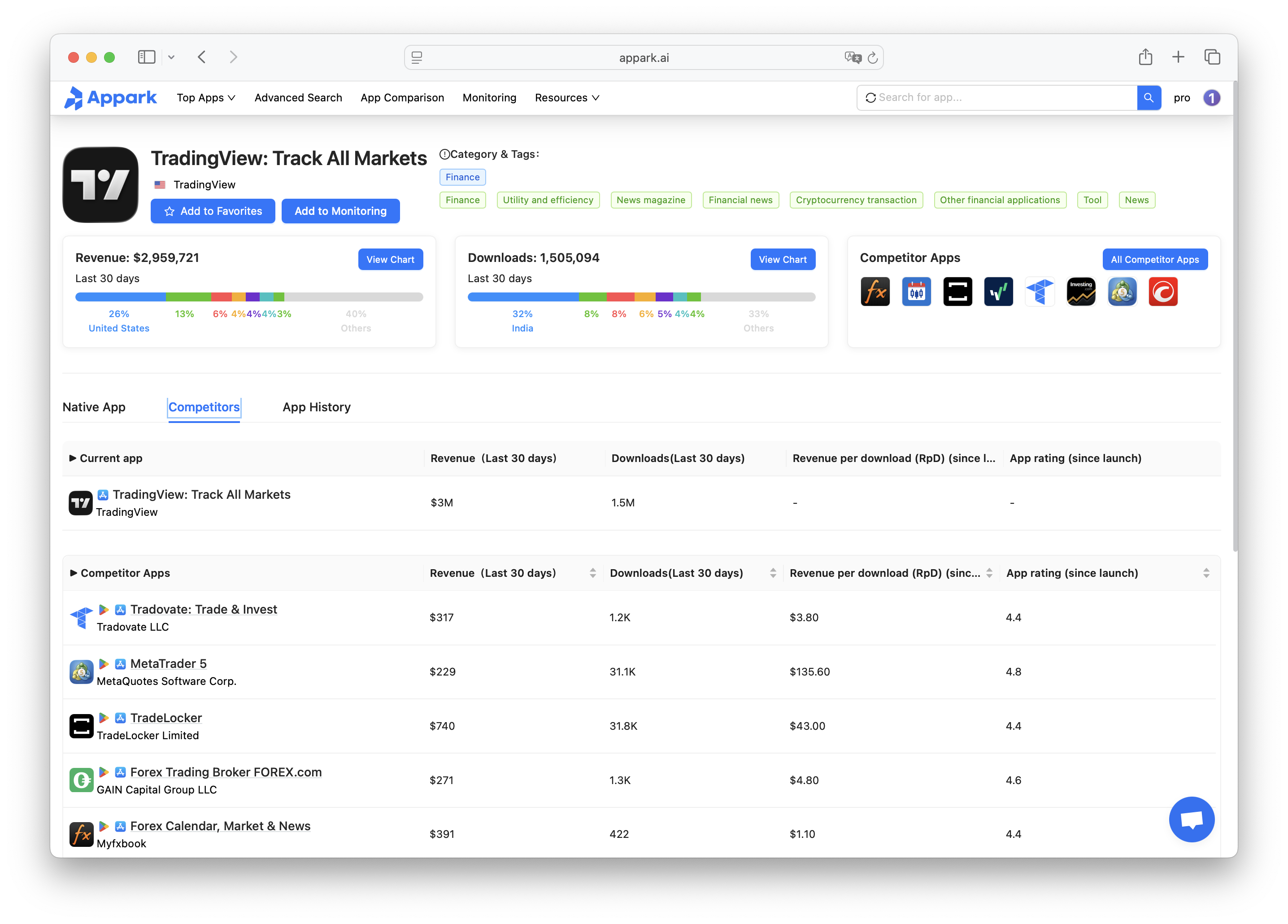

Track hard numbers over time:

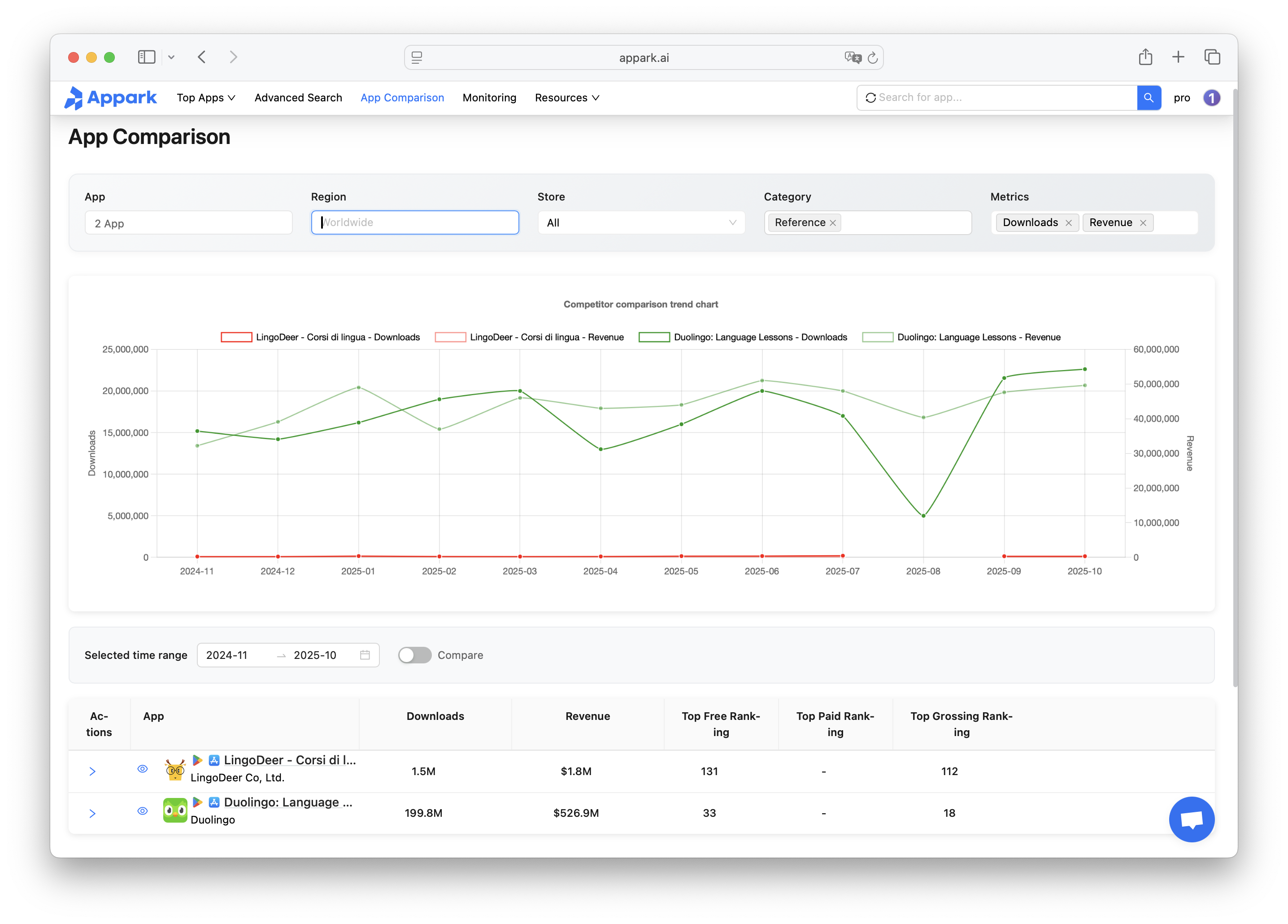

- Downloads (daily/weekly/monthly).

- Revenue patterns and monetization shifts.

- Update cadence and feature launches.

- Country breakdowns and regional traction.

Charts to keep: downloads over time, revenue spikes vs updates, country growth heatmap.

Step 7 — Maintain Continuous Competitor Monitoring

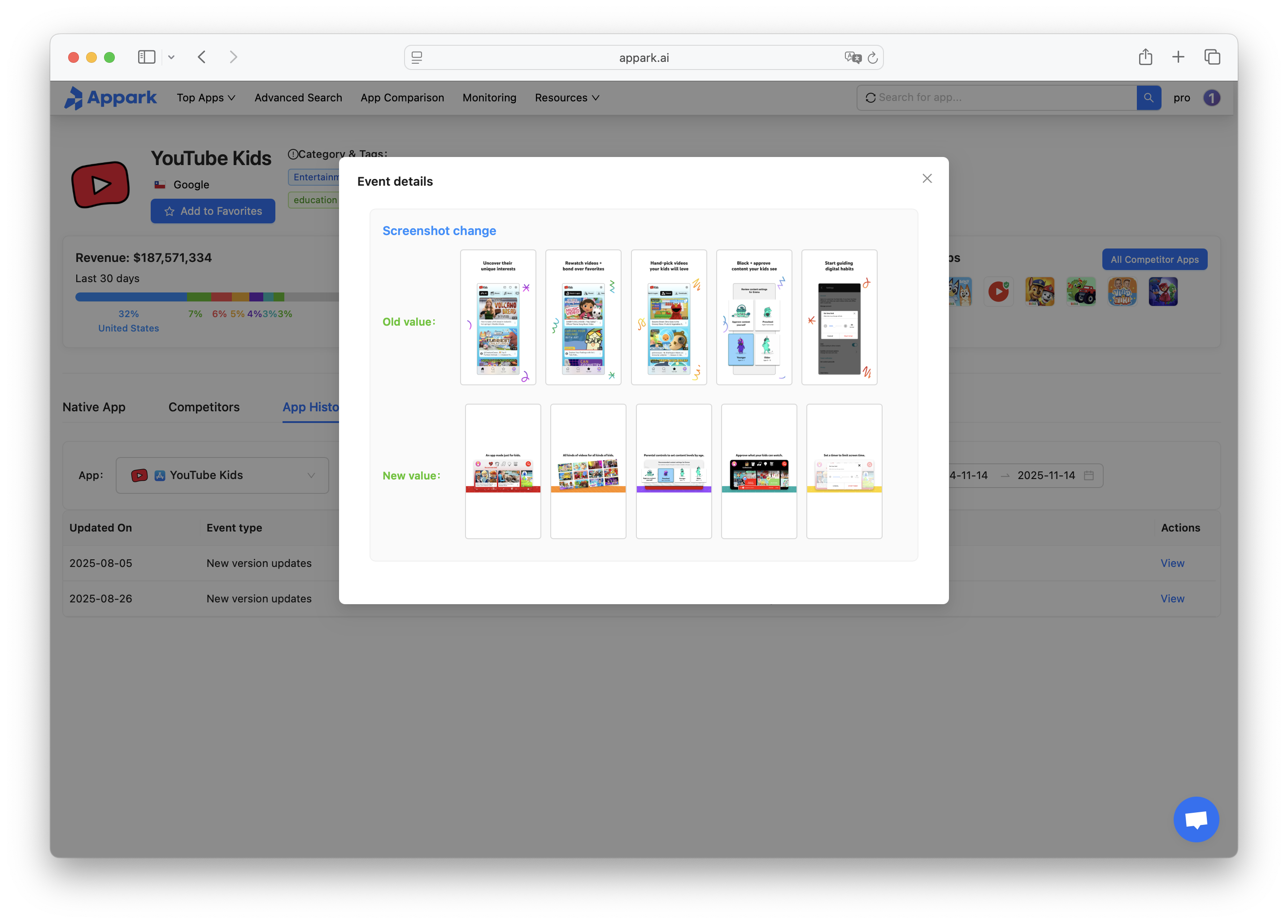

Competitor analysis is ongoing — not a one-off.

- Weekly: quick ranking and creative checks.

- Monthly: deeper metric review and review sentiment.

- Quarterly: strategic review for product prioritization.

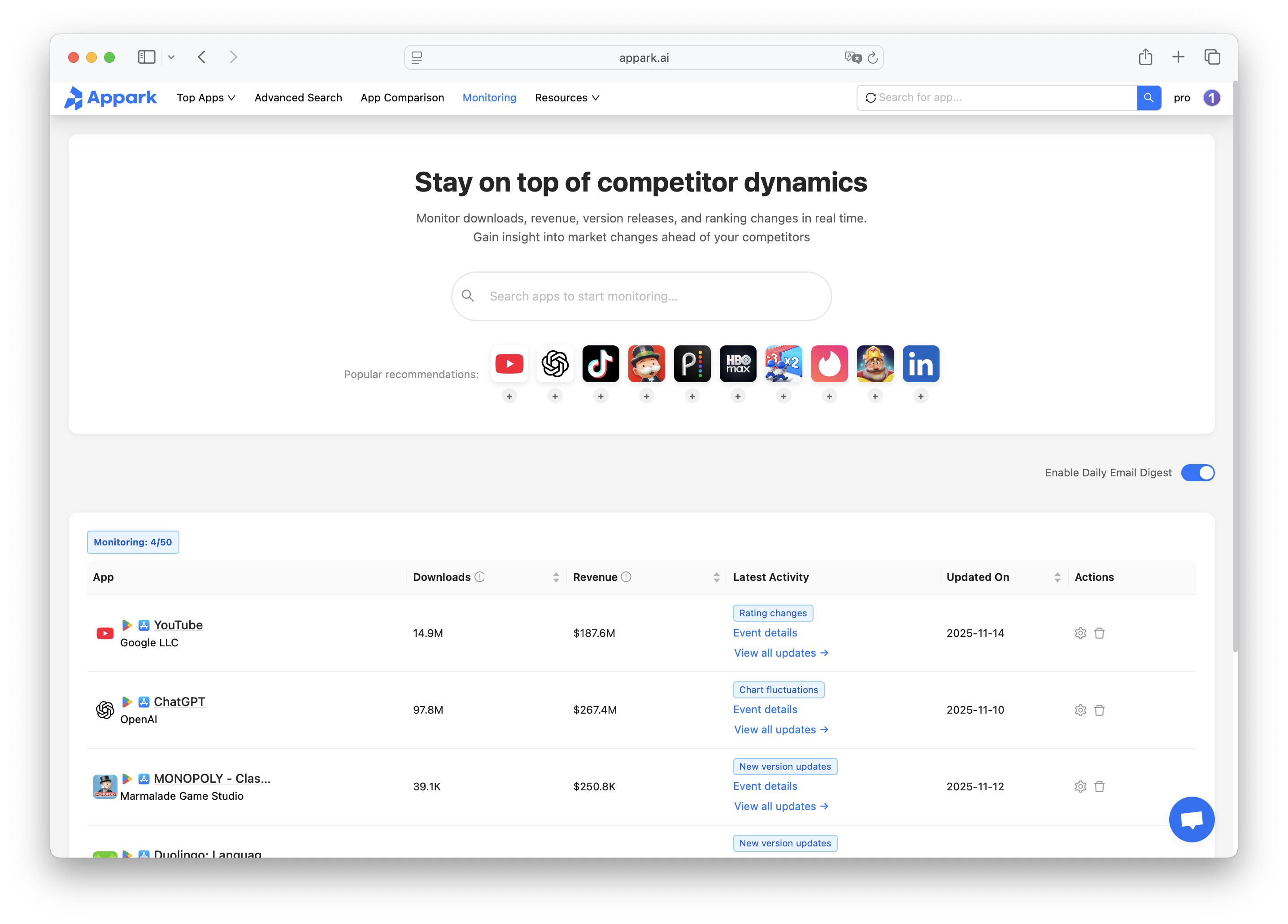

Tool tip: set alerts for sudden download/revenue spikes, metadata changes, or new ad creatives.

Step 8 — Turn Insights into Action (Your 1-Page Roadmap)

Translate analysis into a prioritized plan:

- 3 ASO experiments (icons, screenshots, keywords).

- 3 product experiments (onboarding, core feature, pricing).

- 2 UA experiments (creative test, geo test).

Weekly cadence: 1 test per week.

Measure: uplift in installs, retention, LTV.

Deliverable: one-page roadmap — ASO | Product | UA | Metric to track | Owner | Due date.

Case Study — How Appark Helps You Analyze Competitors in 10 Minutes

Scenario:

You’re building a casual gaming app and want to validate market opportunities.

Using Appark:

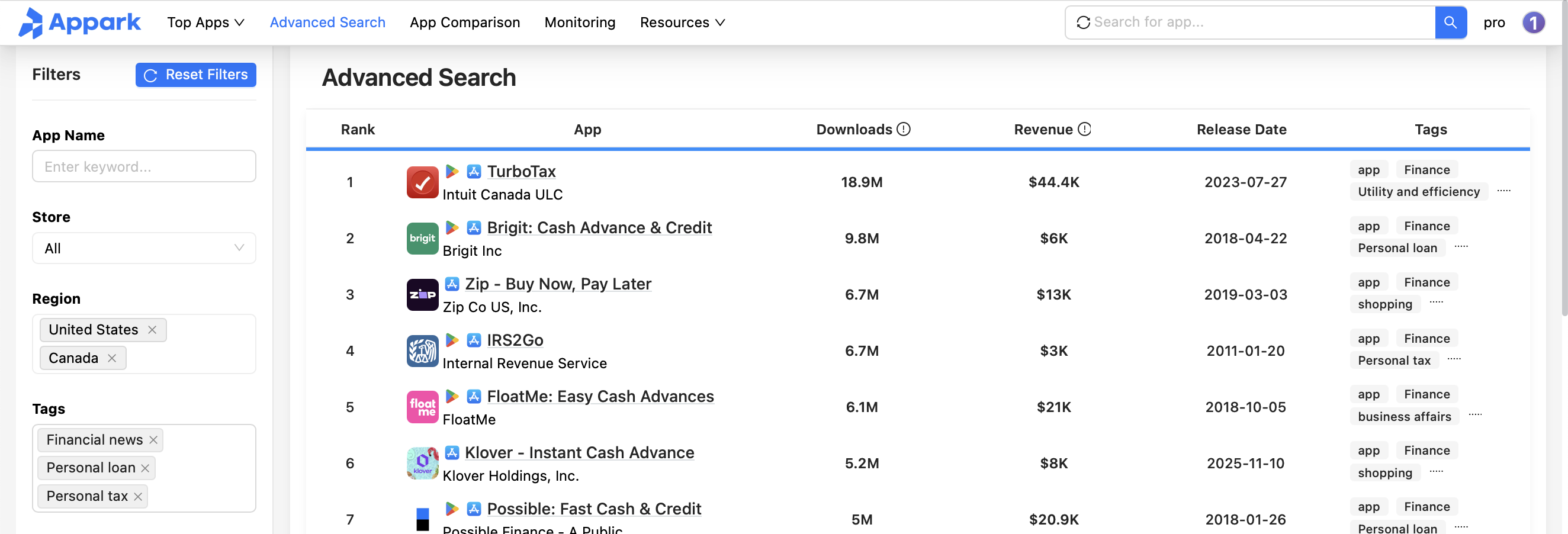

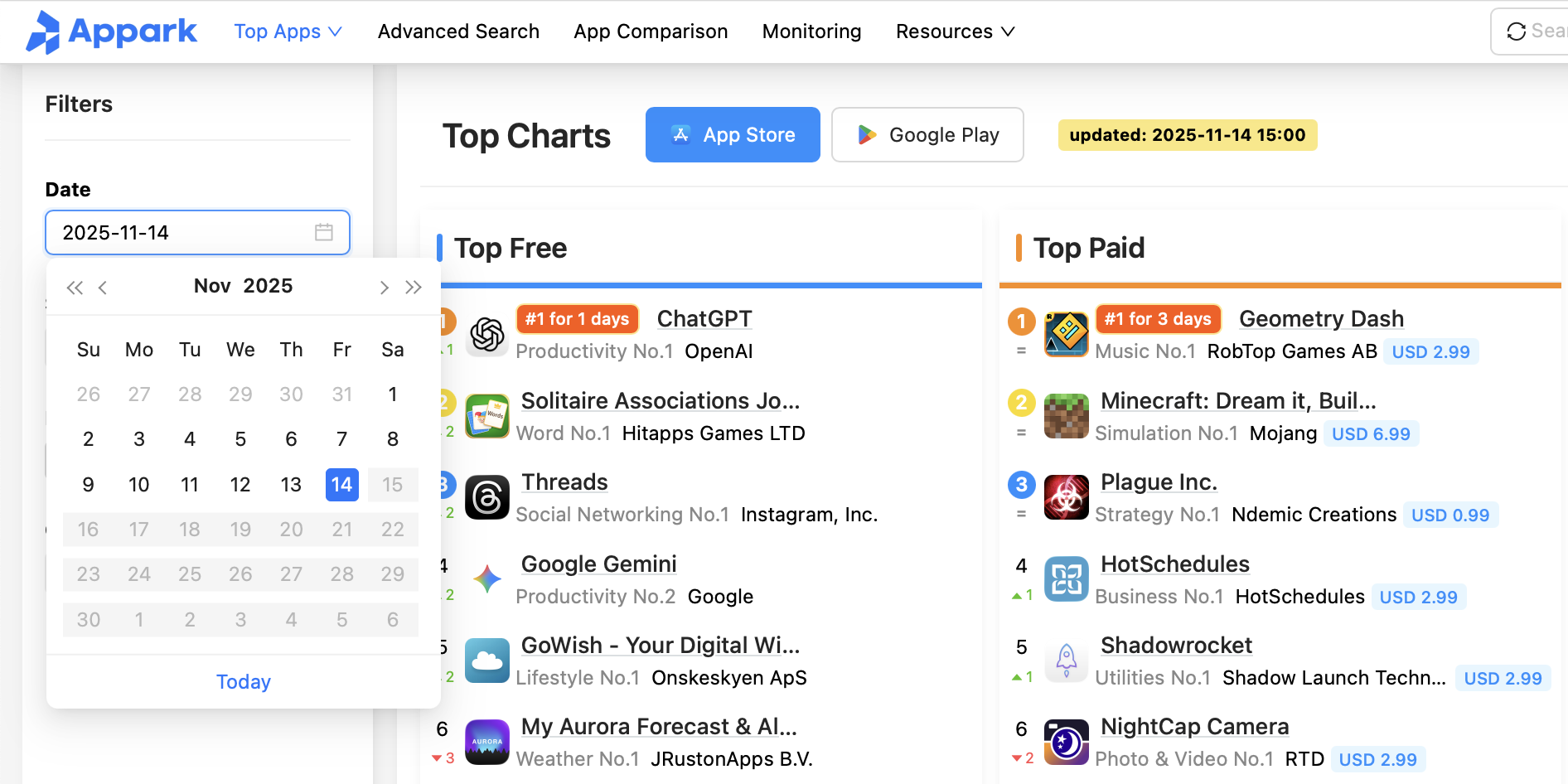

- Advanced Search → filter by genre + country → shortlist fast-growing apps

- Spot which games spiked downloads in the past 30 days

- Compare their monetization: IAP vs ads vs hybrid

- Check top reviews for recurring user frustrations

- Add 3 apps to a monitoring list and receive alerts for changes

Outcome:You discover a category with steady growth in India and Indonesia where no large studio dominates → a perfect soft-launch market.

Best Practices for Effective Mobile App Competitor Analysis

- Start with intent: compare apps that target the same user problem.

- Automate monitoring: alerts > manual checks.

- Triangulate signals: combine downloads + reviews + creatives.

- Measure experiment lift: don’t assume; test.

- Localize analysis: country differences matter.

- Document & repeat: keep a living watchboard and update it.

Common Mistakes & How to Fix Them

Mistake: Copying competitors directly

- Fix: Focus on why something works, not just what works.

Mistake: Only tracking top apps

- Fix: Emerging apps often reveal early trends.

Mistake: Ignoring retention and pricing

- Fix: Downloads alone mislead — look at revenue consistency.

Mistake: Doing analysis once

- Fix: Competitor landscapes shift weekly.

Mistake: Tracking too many metrics

- Fix: Limit to high-value insights (downloads, features, monetization, reviews, creatives).

Why Appark Makes Competitor Analysis Faster & Clearer

Appark helps you turn analysis into action:

- Unified competitor data Rankings, downloads, revenue, creatives — all in one dashboard.

- Instant comparisons View multiple apps side by side to uncover gaps and strengths.

- Monitoring alerts Be instantly notified when competitors launch updates or change strategies.

- Advanced filters Identify rising competitors by release date, region, downloads, or revenue.

- 100% free core features No paywalls blocking essential insights.

Put simply: Appark reduces the friction from data collection to decision. You can identify an opportunity and be testing a hypothesis in days, not weeks.

Conclusion — Turn Competitor Data Into Market Insights

Competitor analysis is not a one-time audit.

It’s an ongoing system that fuels smarter product decisions and faster growth. Follow the** 8-step** process:

- Map the market

- Build the competitor list

- Prioritize

- Analyze ASO

- Identify strengths & weaknesses

- Track performance

- Monitor continuously

- Execute a simple action plan

And with tools like Appark, all the signals you need are collected and organized instantly. Try Appark for free — set up a watchlist, run a 10-minute analysis, and write your one-page roadmap.🚀️